2024 marks the year when China’s Senior-Citizen Economy begins to manifest on a large societal scale, from the perspectives of policy, economy, society, etc.

Policy Factors

Three major policies were introduced, placing the elderly population in a strategically important position in China’s economic and social development:

- The Chinese government released its first policy document explicitly titled “Senior-Citizen Economy” – Opinions on Developing the Senior-Citizen Economy to Enhance the Well-Being of the Elderly.

- Official guidelines on rural elderly care services were issued for the first time nationwide.

- The State Council approved a gradual delay in the statutory retirement age, marking the official decline of China’s demographic dividend, with the senior generation expected to occupy an important position in production and consumption in the coming decades.

Economic Evidence

According to predictions by the China Aging Science Research Center, the scale of China’s Senior-Citizen economy in 2024 is approximately 7 trillion yuan, accounting for about 6% of GDP. By 2035, this figure is expected to grow to 30 trillion yuan, accounting for about 10% of GDP.

Social Environment

By the end of 2023, China’s population aged 60 and above was close to 297 million, accounting for 21.1% of the total population, while the population aged 65 and above was approximately 217 million, accounting for 15.4% (data from the National Bureau of Statistics of China). According to estimates from the UN World Population Prospects 2022, the proportion of China’s population aged 65 and above will reach 21% by 2034 and double to 42.2% by 2085.

On social media, posts about “energetic elders,” “gadgets to entertain seniors,” and “senior-citizen economy entrepreneurial projects” are gaining traction. The economy towards the elderly has already become a sunrise industry in the Chinese market.

Notes about energetic elders and senior-citizen economy on RedNote, Collected by YOYI TECH

This large-scale, fast-growing population is not just a number but individuals with needs and aspirations who must be recognized by society and brands. Drawing from various data points, we attempt to get closer to China’s nearly 300 million elderly, understanding their pain points and needs.

What Do They Look Like?

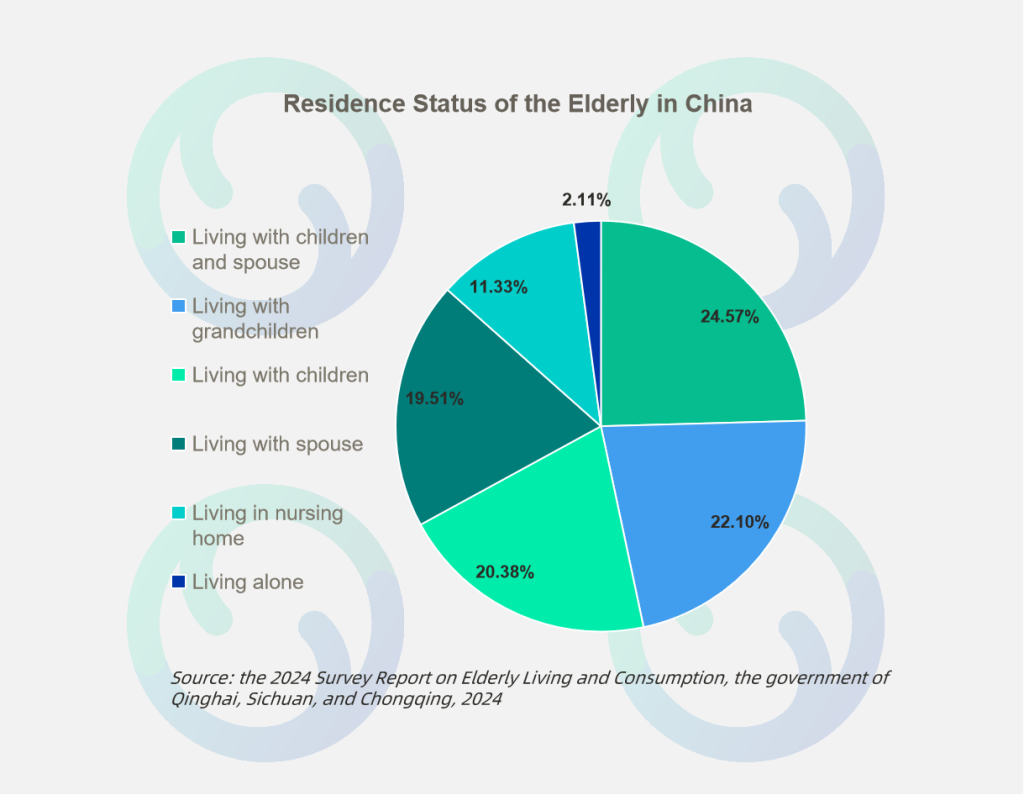

Different cultures shape different lifestyles, and Chinese seniors differ from their foreign counterparts. China emphasizes the concept of “filial piety” and “four generations under one roof,” where parents and children support each other to jointly cope with life’s challenges. According to the 2024 Survey Report on Elderly Living and Consumption conducted by the government of Qinghai, Sichuan, and Chongqing, among nearly 19,000 surveyed seniors, only 13.44% live alone or in elderly care institutions, while the rest live with spouses, children, or other relatives.

Residence Status of the Elderly in China, the Government of Qinghai, Sichuan, and Chongqing

Therefore, decision-makers in the senior-citizen economy must not only focus on the elderly themselves but also consider their spouses, children, and grandchildren as indirect decision-makers.

On this family-oriented foundation, the elderly in China are undergoing new changes in income levels, generational context, life concepts, and consumption psychology: shifting focus from children to themselves, prioritizing quality consumption over low prices, moving from rejecting technology to embracing it, and transitioning from pursuing ordinary lives to boldly chasing dreams.

Consequently, the profiles of the new elders are more diverse. Beyond the “nest guardians” who “help children in any way possible,” there are:

- “Knowledge seekers” who aim to learn properly and thoroughly.

- “Lohas seniors” who live joyfully and spontaneously.

- “Disciplined seniors” who live with a regular rhythm, enjoying freedom through self-discipline.

With such diversity among the elderly population in China, new demands and opportunities are emerging.

Where Do the Opportunities Rest?

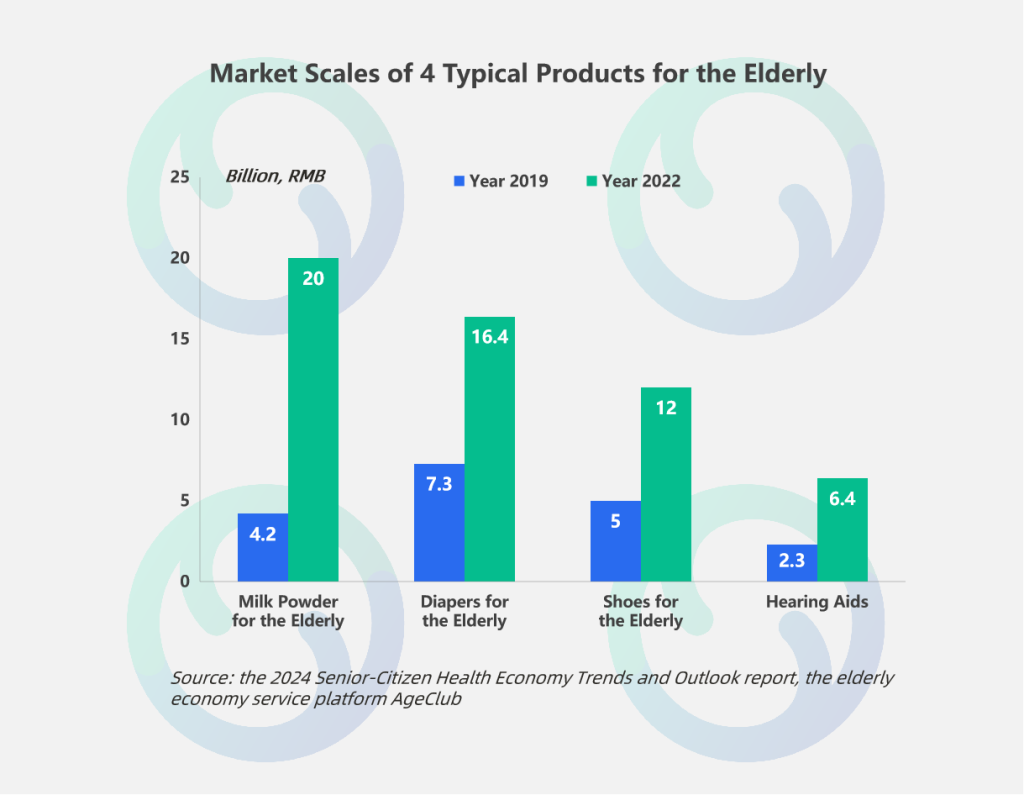

China’s elders represent a “differentiated” market with unique demands. According to the 2024 Senior-Citizen Health Economy Trends and Outlook report by the elderly economy service platform AgeClub, the markets for senior milk powder, adult diapers, elderly footwear, and hearing aids grew by 1x to 4x between 2019 and 2022.

Market Scales of 4 Typical Products for the Elderly

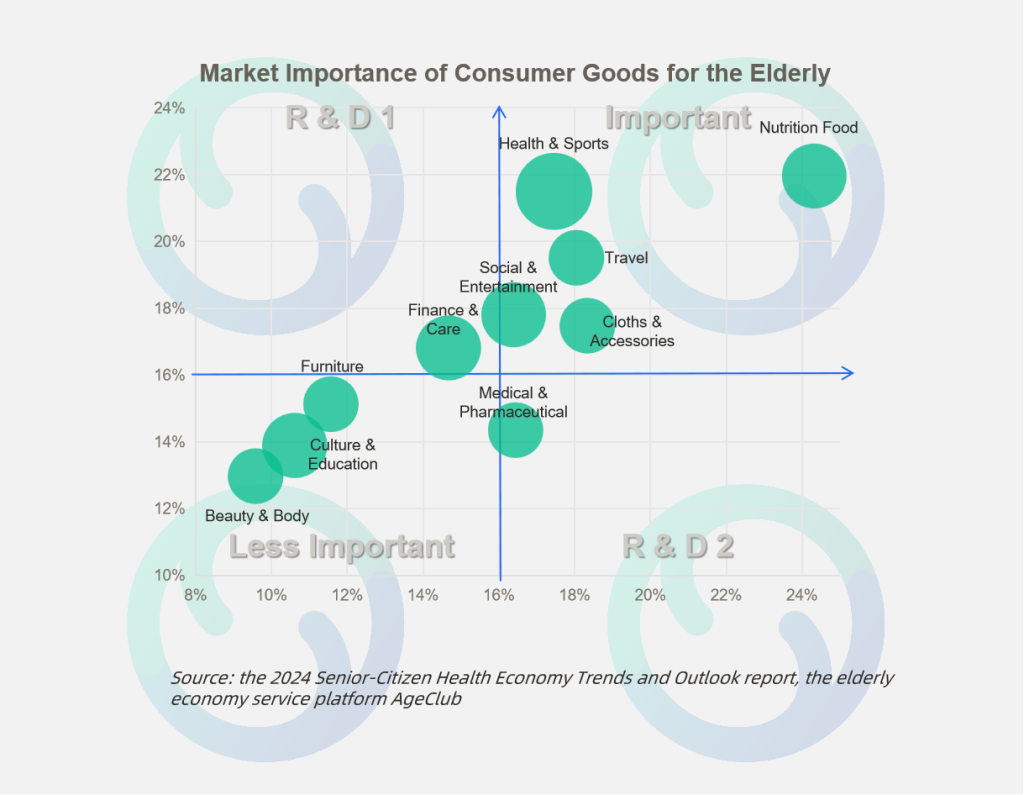

By integrating two dimensions – the “importance of the category” and “level of consumer spending” – the report identified three categories that today’s elders deem necessary and are willing to spend on: nutrition and food, health and sports, and travel.

Market Importance of Consumer Goods for the Elderly

Market Importance of Consumer Goods for the Elderly

Drawing inspiration from Japan’s aging society a decade ago, which shares similar demographic characteristics with today’s China, potential future categories may include:

- Food and dining

- Travel and leisure

- Entertainment

- Delivery services

- Interest-based learning

- Apparel and daily goods

- Recreational sports

- Other niche services (e.g., matchmaking services and senior-friendly mobile phones)

A noteworthy trend is that the elder generation is breaking away from the “social clock,” with consumption scenarios increasingly reflecting youthful preferences.

A survey by JingDong Consumption and Industry Development Research Institute compared 500 elder individuals with 500 younger individuals and found overlaps in consumer behavior, sports preferences, travel destinations, skincare habits, and mental wellness.

- Sports Preferences: Walking, hiking, badminton, and cycling are popular among both groups.

- Travel Preferences: Both prefer local travel, enjoying City Walks, City Rides, hiking, and mountain retreats in autumn for activities like camping, meditation, and spiritual exploration.

- Fashion: Both groups favor activewear, modern Chinese styles, and Hanfu. Relaxing colors such as gray, beige, and brown are universally liked.

- Skincare: Both prioritize maintaining skin health, focusing on sun protection, cleaning, and anti-aging.

- Reading: Popular categories overlap, including travel guides, bestsellers, psychology books, and literature.

According to TV shopping company Happigo’s 2024 data, elder consumers have high demand and growth in:

Health Products:

- Nutritional items (e.g., flaxseed oil, krill oil, camel milk powder).

- Health aids (e.g., pain relief patches, foot bath bags).

- Medical devices (e.g., blood glucose monitors, pulse oximeters).

- Health services (e.g., records management, genetic testing, traditional Chinese medicine).

Everyday Needs:

- Notable growth in beauty and fashion-related items. Demand for reading glasses, for instance, has shifted from purely functional to trendy, with seniors now seeking fashionable designs to match different outfits.

How to Reach the Elderly Group in China?

Driven by the digital wave, the elder generation is embracing the internet and becoming “trendy surfers” actively engaging online. According to the 2024 Senior-Citizen Health Economy Trends and Outlook report, as of June 2024, the number of internet users aged 60 and above reached 371 million, making up 15.6% of total internet users, with an internet penetration rate of 57.5%. Seniors are spending increasing time online, enjoying the convenience and entertainment it brings, just like younger generations.

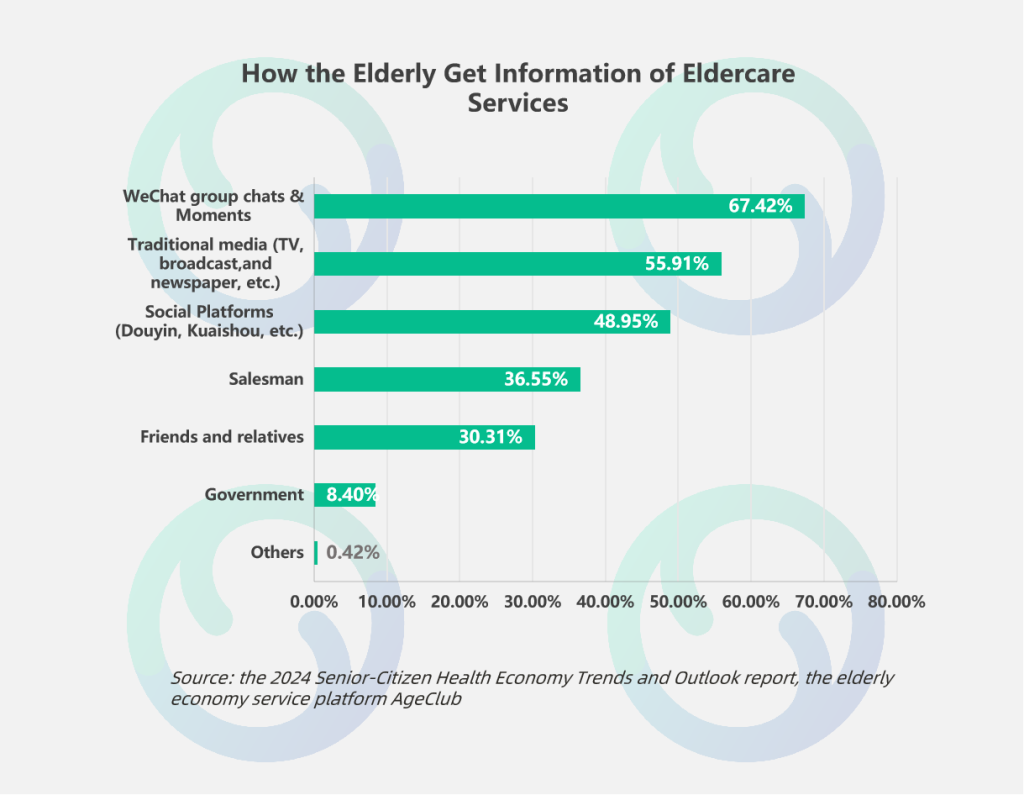

How the Elderly Get Information about Eldercare Services

According to the 2024 Survey Report on Elderly Living and Consumption, seniors access information on elderly services through three primary channels:

- Social tools like WeChat group chats and Moments.

- Traditional media like television, radio, and newspapers.

- Social platforms like Douyin (TikTok in China) and Kuaishou.

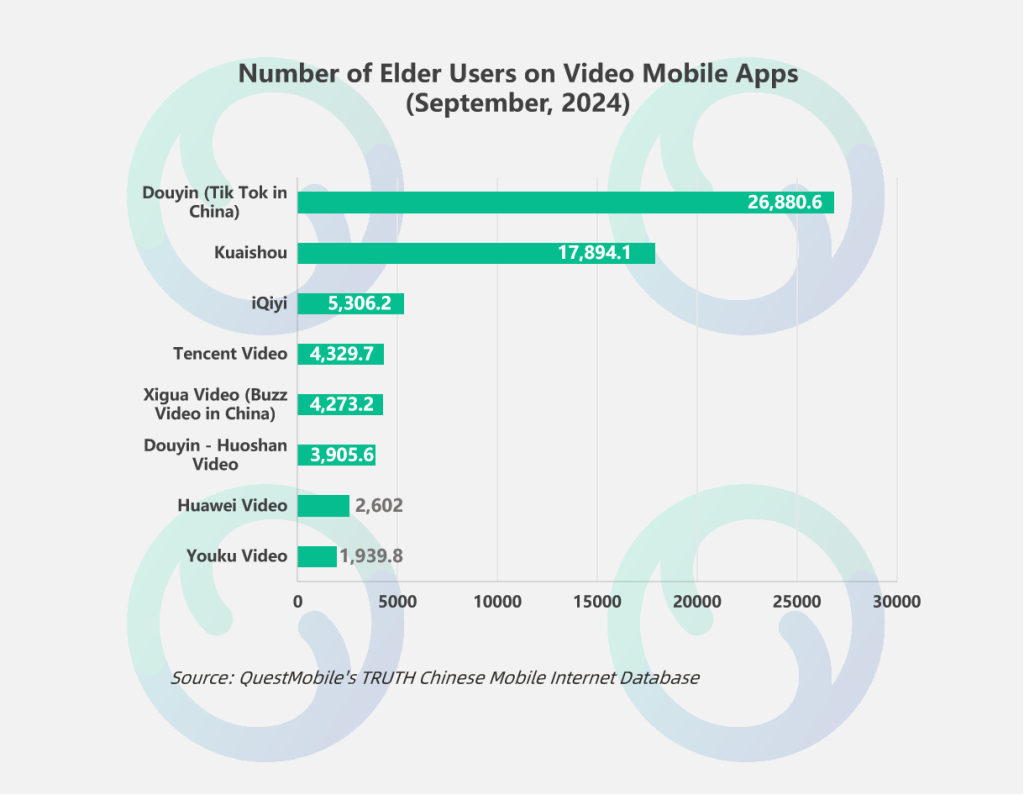

Number of Elder Users on Video Mobile Apps (September 2024)

Like younger generations, seniors enjoy short-form and easily digestible content, such as short videos and mini-dramas. Data from QuestMobile’s TRUTH Chinese Mobile Internet Database shows that, as of September 2024, seniors are more active on short video platforms like Douyin and Kuaishou than on other platforms.

Moreover, according to data disclosed by Xiaohongshu in January, as of the end of 2024, its monthly active users aged 60 and above exceeded 30 million. Over the past two years, the number of senior creators on Xiaohongshu has tripled, with over 100 million notes published. Xiaohongshu has even introduced a senior-friendly usage guide featuring enlarged text, detailed instructions, and 1:1 interface illustrations.

The Elder Generation as a Core Consumer Group

China’s population aged 60 and above will grow significantly in the coming decades, making it an indispensable force in the country’s social and economic fabric. Brands are already planning for this demographic shift, building a “second growth curve” in China. Examples include:

- The baby care industry launching senior milk powder and diapers.

- The banking and insurance sectors introducing elderly pensions and critical illness coverage.

- The personal care, beauty, healthcare, and nutrition industries early on tapping into the elderly market.

YOYI TECH has developed an intelligent omnichannel marketing platform over more than a decade of technical upgrades and product refinement. With experience serving 1,000+ domestic and international brands, YOYI TECH has established a mature market expansion approach, helping 80% of Fortune Global 500 companies enter and thrive in the Chinese market with ease and effectiveness. To customize your marketing strategy towards Chinese senior citizens, feel free to contact us.

Source of featured image: Photo by Mark Hang Fung So on Unsplash