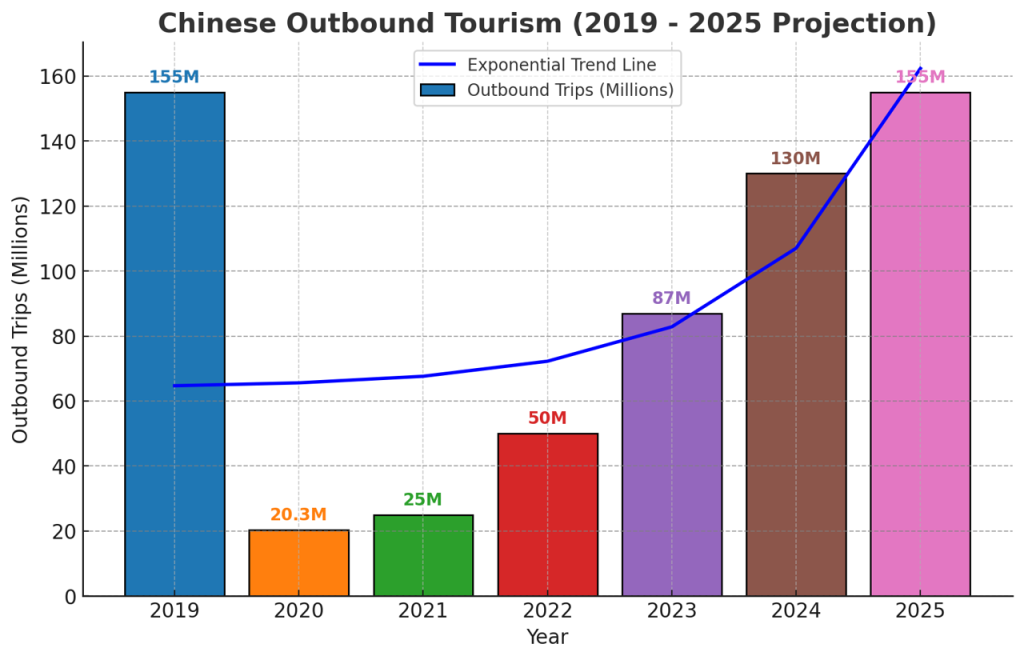

China’s outbound travel market is set for a full recovery by 2025 after years of turbulence caused by the pandemic. According to Future Market Insights, the number of outbound Chinese travelers is projected to reach 155 million in 2025, returning to pre-pandemic levels.

This recovery is not just about numbers; significant shifts in consumer preferences and destination choices also accompany it. While the Middle East and North Africa (MENA) region is not yet among the top 20 destinations for Chinese travelers (according to Travel Weekly Asia), data from niche markets suggests a growing demand. China Daily reports that flights from China to Saudi Arabia increased by 130% year-over-year in 2024, signaling a transformation of the Middle East from a niche destination to a high-potential market.

The Rise of the Middle East: Policy Incentives & Consumption Upgrades

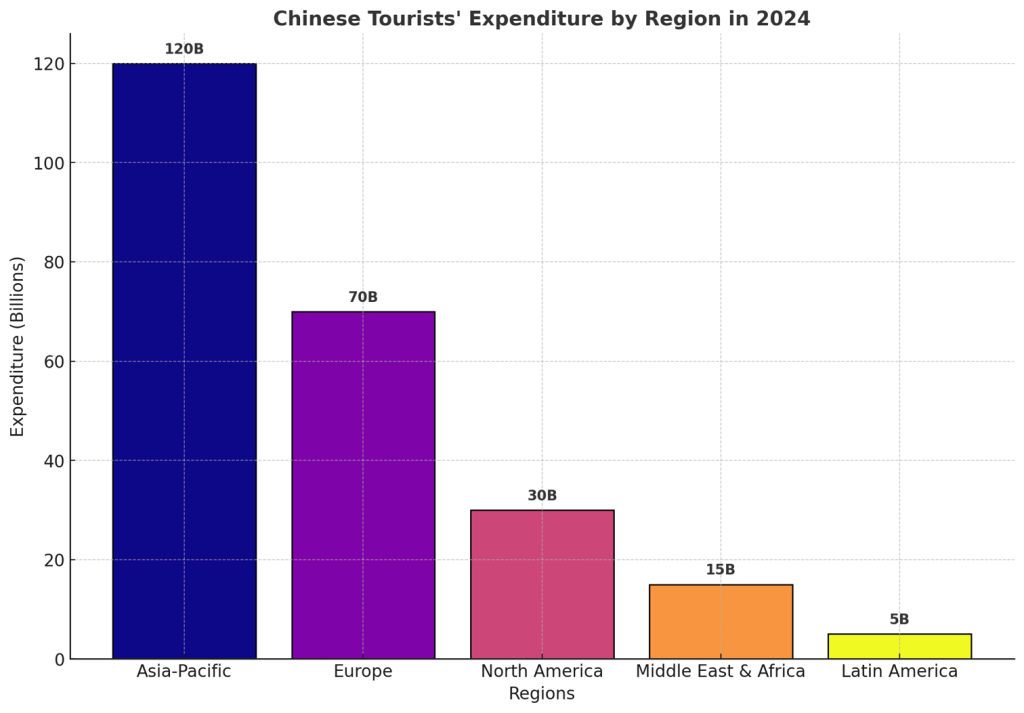

Currently, the Middle East accounts for just 2.1% of China’s outbound travel market (Statista), but its rapid growth trajectory is undeniable. Qunar’s 2024 travel data reveals that Chinese bookings for Middle Eastern destinations have surged, with the UAE experiencing a 62% increase in overall bookings. Abu Dhabi and Dubai, in particular, recorded significant growth, at 72% and 61%, respectively. This surge is driven by two key factors: first, visa facilitation and increased flight connectivity, making the region more accessible; second, the rising demand among China’s high-net-worth travelers for immersive experiences that blend cultural uniqueness with luxury. The Middle East is transitioning from a business stopover to a premium tourism hub that combines high-end services with cultural exploration.

2024 Growth Landscape: Business Travel, FIT, and Air Connectivity

Structural shifts in China’s outbound travel to the Middle East are becoming increasingly evident. In the business sector, the number of Chinese corporate travelers to the region has been steadily increasing since February 2023. According to China Daily, the number of Chinese exhibitors participating in Middle Eastern international trade shows in 2024 has doubled compared to pre-pandemic levels in 2019, making the region a crucial hub for corporate globalization. At the same time, air travel capacity has significantly expanded, injecting new momentum into market growth. Direct flights between China and Saudi Arabia have increased by 130% year-over-year, while carriers such as Emirates and Qatar Airways have launched new routes connecting Beijing and Shanghai with Dubai and Doha, greatly improving accessibility.

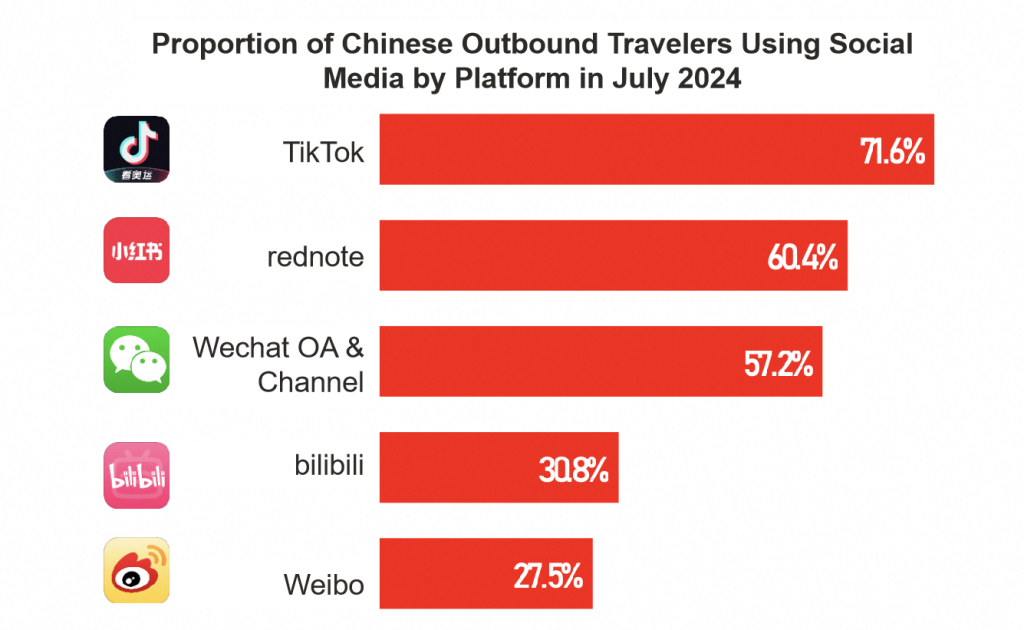

The rise of social media and digital services has also profoundly reshaped the travel decision-making process. According to Fastdata’s 2024 China Outbound Travel Industry Trend Report, social media is now the primary channel through which Chinese consumers discover travel ideas, with Douyin, Xiaohongshu, and WeChat ranking as the top three platforms. The proliferation of short videos, live-streaming commerce, and influencer-driven content has enabled travelers to access tourism information through diverse online channels, making trip planning more flexible and fueling the growth of independent travel.

China’s free independent travelers (FITs) are redefining the way the outbound tourism industry operates. A significant number of travelers now complete all bookings—accommodation, transportation, and attraction tickets—online before departure. For OTAs, travel agencies, airlines, hotels, attractions, and car rental companies, adapting to the growing preference for independent travel among Chinese consumers presents new business opportunities in the outbound tourism sector.

Consumer Insights: Segmented Needs Create Precision Marketing Opportunities

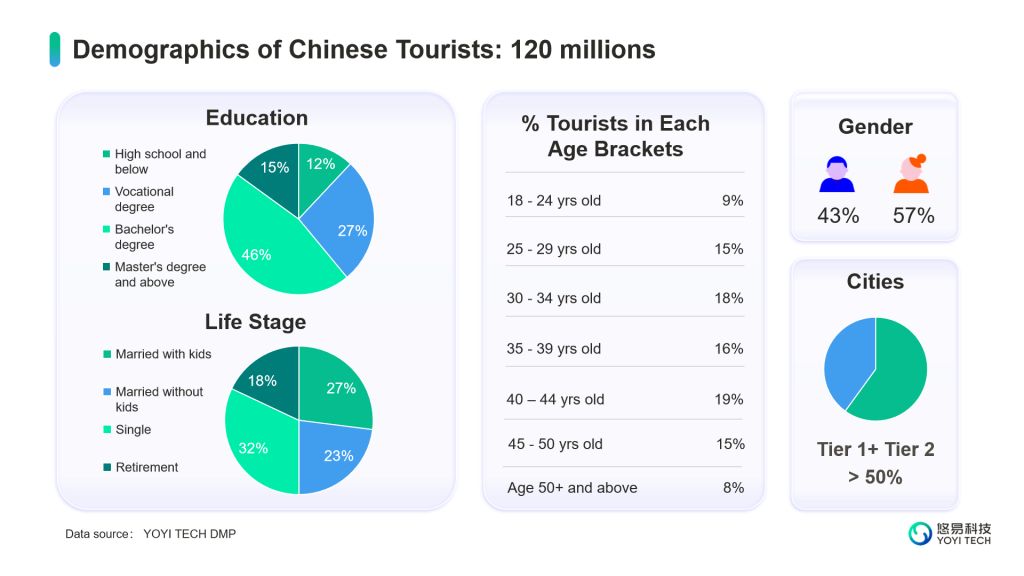

From a demographic perspective, China’s travelers exhibit a distinct “dumbbell-shaped” age distribution. According to YOYI TECH’s DMP data, travelers aged 30 to 39 account for 34% of the market, making them the primary spending group. The 25 to 29 age group represents 15%, while those aged 40 to 44 account for 19%, illustrating the coexistence of demand from both affluent middle-aged travelers and young explorers. Geographically, more than 50% of outbound travelers come from Tier-1 and Tier-2 cities, further reinforcing their strong spending power.

To effectively cater to these travelers, tourism businesses should focus on three core strategies. First, developing differentiated travel products tailored to distinct customer segments, such as investment tours and golf networking packages for business travelers or cultural workshops combined with must-visit social media hotspots for younger tourists. Second, enhancing service customization by addressing the shortage of Chinese-speaking tour guides and introducing localized Middle Eastern cuisine adapted to Chinese palates. Third, strengthening digital marketing strategies by leveraging platforms like Douyin and Alipay, using live-streaming promotions and exclusive discount campaigns to boost conversion rates.

Future Outlook: Building a Closed-Loop Ecosystem & Unlocking Market Value

The Middle Eastern tourism sector is entering a positive feedback loop, driven by policy liberalization, increasing demand, and the gradual improvement of tourism infrastructure. With large-scale projects such as Saudi Arabia’s NEOM “Future City” and Oman’s ecotourism development zones, opportunities for Chinese businesses are expanding. To capture this emerging market, companies should focus on three key areas:

- Deep integration of resources: Collaborate with local hotels and shopping malls to develop exclusive travel packages, enhancing profitability.

- Creating full-service travel bundles: Offer “flights + visa + hotel + shopping discounts” in a seamless one-stop package to increase per-customer spending.

- Data-driven precision marketing: Utilize DMP systems to identify the distinct needs of high-net-worth individuals and Gen Z travelers, enabling targeted marketing strategies.

The Middle East is not only a critical region in China’s Belt and Road Initiative but also a testing ground for the transition of China’s outbound travel sector from volume-driven expansion to high-value market penetration. Companies that successfully integrate cultural experiences with digital transformation will gain a long-term competitive advantage in this rapidly evolving travel landscape.

Feature image is photoed by Fredrik Öhlander on Unsplash